Those nervous of change need read no further. If a survey of phrases commonly associated with the gas industry could be collated then it’s likely that “constantly changing” would be amongst the most popular. In a highly competitive, regulated market such change is perhaps a given. Since privatisation the industry has continually evolved, riding a technological rollercoaster adapting itself to the ever-changing needs of the end consumer, the environment, the requirements of the regulator and successive governments.

Reflecting back on the numerous changes since the previous newsletter, it is easy to feel a sense of overwhelmingness by the sheer volume and variety of reform and place further hope that internal change management programmes can keep up with the fast pace of market developments.

Unidentified Gas (UIG) Update

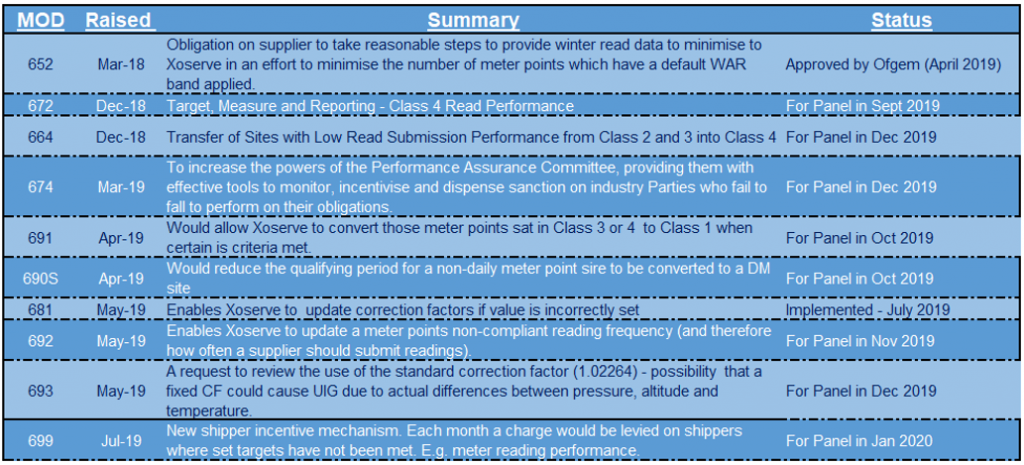

As reported in our previous newsletters, Xoserve’s UIG Taskforce presented its findings and recommendations to the Joint Office UIG Working Group in late January 2019. Whilst no one single issue could be directly attributed to UIG the Taskforce did point to some “quick wins” in the form of practical changes which could help to alleviate both the high level and volatility of UIG. Whilst UIG Taskforce work continues, a wave of Uniform Network Code (UNC) Modifications have been published, with other Modifications (pre-dating January’s findings) progressing to advanced workgroup stages. The table provides a high-level summary of the relevant UIG Modifications (Mods).

With reference to the table, there are perhaps two distinct themes running throughout the Mods. The first theme relates to the submission of regular, quality meter reading data and the second theme addresses supply point metering data quality. The latter theme enables Xoserve (the Central Data Services Provider) to take over the housekeeping of certain data items in the event that a supplier does not, in a bid to keep potential UIG drivers under check.

For the reader the first theme perhaps raises an eyebrow – surely the provision of regular, quality meter readings is a necessity for a supplier, especially for settlement purposes. This is true. Readings submitted will allow for reconciliation against a previous allocation, and a new Annual Quantity (AQ) will be applied which leads to better energy allocation (and costings) in the future. Furthermore, under the license suppliers are required to take all reasonable steps to obtain a meter reading at least once a year or monthly in the case of customers with a smart or advanced meter. The obligation of sending monthly readings for smart or advanced meters was only introduced in April 2018 following the publication of the Competition and Markets Authority (CMA) investigation into the state of the Energy market.

Smart and Advanced Reading Performance

Meter read submission data produced by Xoserve shows improvements to those annually read (non-smart or advanced) meters in Supply Point Class 4, with a 92% reading rating, although performance falls to 77% for those Class 4 meters with smart or advanced capability. For Class 3 and Class 2 sites (which are required to have remote capability) read performance percentages are lower at 66% and 70% – far from the required 97.5% and 90% obligation. According to the latest Government official statistics there are around 14.9 million smart or advanced meters, so the capability to submit a significant quantity of reading data exists. Putting the fact that 1.5m smart meters are operating in “dumb mode” to one side, the overall reading performance of smart and advanced metering appears poor considering that its very technological existence is built upon meter data provision and transmission.

Performance related modifications (namely 672, 652, 664 and 699) actually provides us with a third theme. Such modifications underpinned by robust governance and potential financial incentives (699) will inevitably force a change meter processing for many suppliers and may eventual – possibly – positively contribute to overall UIG stabilisation.

Faster and More Reliable Switching

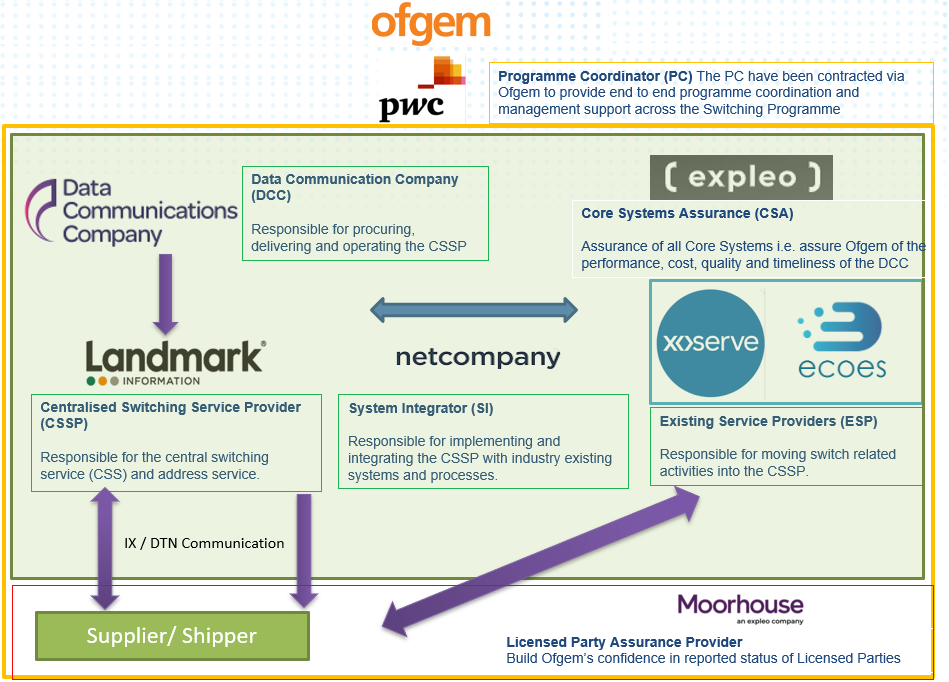

We set the scene for the Faster and More Reliable Switching programme back in our Autumn 2018 Newsletter. Since then the Ofgem-led programme moved up a gear as the project has moved into its Design, Build and Test phase. To get to this point several industry service providers and various independent project assurance bodies have been contracted, with the collective aim of implementing a new switching platform for Summer 2021.

The scale of this project is unprecedented – Project Nexus (2017) by way of comparison was only the warm up act ensuring that shippers and suppliers could interact with Xoserve’s new UK Link system which in turn would provide a scalable platform to support faster switching and cost allocation in the future. Yet the switching programme is bigger in terms of its costs, the number of stakeholders involved (now including the electricity market) and its outcomes given that the consumer will experience the benefits.

Project interactions can be summarised in the accompanying graphic. In essence all existing switching functions that we see today will be stripped out of Xoserve (gas) and Ecoes (electricity) and combined under the Centralised Switching Service (CSS) operated by a newly appointed organisation, Landmark. All remaining activities (such as metering and settlement) will continue within Xoserve and Ecoes respectively, although bridges will need to be established between all parties concerned to ensure that switch related activities are synchronised.

The Change?

From a supplier perspective, IT systems need to be split out ensuring that switching related activities are designed to the new CSS specification. Former switching data sets which would have otherwise been sent to Xosevre/Ecoes will have to be revised and new messages will have to be established to ensure that switching synchronisation can be maintained. Change requirements will be captured through attending industry forums and dissecting design specifications. Engagement with the industry will take place under the gaze of independent project assurance, which will require, amongst other things, suppliers to provide self-assessments against key project milestones.

The Cost?

Ofgem’s final business case (published in May 2019) puts costs to be in the region of up to £426 million spread over 18 years (based on 3 years’ worth of design and 15 years of operation). This cost estimate was up £94m from its initial February 2018 business case and was attributed to a longer Design, Build and Test phase and revised cost estimates from its Service Providers. The benefits for the consumer are, however, likely to be in the region of between £185m to £1,077m. These savings are based on the assumption of the savings that customers may expect to receive from switching and the amount of switching that occurs. Cost aside, for Ofgem the case for action is “compelling” in that the programme will provide the future platform that will support the ongoing digitalisation, decarbonisation and decentralisation of the energy industry.

Strategic Reviews…

Future Energy Market Review

On the 6th March 2019 Ofgem and the Department for Business, Energy and Industrial Strategy (BEIS) announced the start of a joint programme to review the energy retail market. The objective of such a review is to examine the markets current design and identify what major changes are required in order for consumers to benefit from a digitalised, decarbonised and smarter energy system.

Such a review has come about in recognition that the existing retail market structure (created in 1998) will be unable to withstand the current patch and plaster approach that the retail market has adapted over the years. Whilst the current market has brought about benefits such as the introduction of consumer protections (the default tariff price cap for instance) and industry process reforms, the overall framework, according to the review, is too rigid and inflexible, holding back innovative business models who could otherwise offer consumers alternative energy solutions.

For BEIS-Ofgem the retail energy market of the future needs to be able to promote competition; support decarbonisation; embrace innovation; be flexible enough to respond to the changing needs of consumers and; provide fair outcomes for consumers – such desirables of which are welcomed by many. The need to shake up the retail market is even more pressing with the recent “net-zero” carbon target announcement by the government.

In terms of progress there is little more to share, although it is widely expected that the forthcoming Energy White Paper will likely hook into the direction of the review. According to BEIS-Ofgem, the Government will legislate in a subsequent session of this Parliament if the outcomes from the review warrant it to do so, especially if it is realised that future consumer benefits are likely to be gained. Such legislation will no doubt set the foundations for a post price-cap retail market from 2023 and trigger a wave of further changes for energy suppliers in terms of how they potentially engage and interact within the marketplace.

Microbusiness Strategic Review – Call for Evidence

Not long after the future retail market review announcement, Ofgem launched a strategic review of the microbusiness market on 3rd May 2019. For years the Regulators attention has been focused on consumer outcomes related to the domestic market sector with the non-domestic microbusiness sector, whilst equally important, largely being left on tick-over. This doesn’t mean to say that the microbusiness sector has been ignored. As recently as last November new rules came into force relating to microbusiness back-billing and prior to this there was reform to how microbusiness consumers should be treated fairly. Beyond the license requirements, suppliers have had to incorporate changes relating to online price transparency as ordered by the CMA; and beyond this some suppliers have become more transparent with their credit balance polices and how they interact with Third Party Intermediaries.

However, the evidence that Ofgem has gathered to date suggests that the microbusiness market is not at all working well with examples of consumer disengagement and detriment. Its published research includes an assessment on the effectiveness of the CMAs price transparency remedy (June 2017), which required suppliers to provide clear pricing to microbusiness consumers through a web-based quotation tool, showed that its not had the desired effect. Reasons for this include the complexity of non-domestic pricing; inconsistent applications of the tool; low awareness; and the almost obvious statement that microbusinesses tend to fully rely on the services of TPIs to access the market.

The microbusiness review therefore calls upon industry stakeholders to provide evidence to Ofgem to allow it to ascertain whether its presumptions (‘theories of harm’) are accurate and if so, the way forward. The call for evidence asks stakeholders to consider various areas including: market complexity; the cost of disengagement; barriers to accessing data; microbusiness awareness; browsing; supplier dialogue; and contracting. Depending on the evidence gathered the ‘contracting’ item could be by far the major change in terms of the clarity of information provided to a consumer at the point of sale as well as the transparency of arrangements that exist between a supplier and TPI.

The evidence collected will feedback into the wider energy market review with policy intentions likely being presented to the industry in Winter 2019.

Ofgem Review of Licensing Arrangements

As discussed in the previous newsletter, Ofgem’s review of its licensing arrangements was in part triggered by a successive number of suppliers failing in a relatively short period of time.

On April 11th 2019 Ofgem announced that the requirements for when they would grant a supply license would be strengthened with additional criteria placed on applicants wishing to enter, extend or transfer supply licenses. To assess the credibility of an applicant, Ofgem announced that they would apply more qualitative assessments on new applications with consideration given to the applicant’s resources, understanding of their regulatory requirements and assessment on whether the applicant is ‘fit and proper’ to hold a license. Such changes were also packaged up with an increased application fee to discourage all but the serious.

Whilst market entry changes may have little impact for established market participants, it is highly likely that the real impact of change will be felt through subsequent reforms arising out of Ofgem’s assessment into the “On-Going” and “Exit” license arrangements.

The suggested On-Going changes put forward to stakeholders include a suite of new license conditions which would compel suppliers to ensure that they have the capability, processes and systems in place to service all their customers, with certain reporting to Ofgem set at pre-determined intervals (such as customer size). Other suggestions include ways to ring fence domestic credit balances (currently the largest cost for the industry should a supplier fail) regular reporting, independent audits and the accountability of key individuals. As for Exit requirements, the main theme revolves around improving the efficiency and competitiveness of the Supplier of Last Resort process, with additional supplier license conditions which could see suppliers regularly backing up their data or ensuring that it is updated in a standardised format which will allow for easier data portability.

Net Zero economy

Spurred on by the Committee on Climate Change’s (CCC) report which recommended a net zero target for all greenhouse gases, the recent announcement by the government to achieve this target by 2050 is significant as well as historic. Recently there have been several policies introduced which will lead to a change either in lifestyle or behaviour. From 2025, gas boilers will be banned from new homes. By 2040 all new cars will be “effectively zero emission” which will no doubt see a large portion of motorists driving electric vehicles. By 2050 society norms and values are likely to be orientated towards cleaner and sustainable forms of energy in a way which we struggle to comprehend today. The much-anticipated Energy White Paper will likely provide the policy substance that supports the government net zero commitment and this will likely act as the catalyst for further changes within the industry.

Focussing on the gas market specifically, it is recognised that real challenges lay ahead particularly on our dependence for gas used for heating. Decarbonising the industry will have to take on a pragmatic approach recognising that certain UK areas or regions, homes or businesses will likely require different solutions. Such solutions already exist or are in the process of being developed. Producing low carbon Hydrogen is advancing with active trails ongoing by some Gas Distribution Networks; this is supported by a £25m Hydrogen for Heat programme operated by BEIS. In March 2019 the Chancellor’s Spring Statement announced a further commitment to inject more Green Gas (bio-methane) into the network. The growing popularity of bio-methane (Green Gas) over the past 12 months is leading to a take up by many suppliers including Crown Gas and Power. Additionally, BEIS announced that it had launched a consultation on an energy efficiency scheme for small and medium sized enterprises, measures which will likely be a driver for behavioural change, a key factor if the net zero target is to be realised in the future.

The net zero transformation occurring to the energy industry will hopefully lead to positive outcomes for all stakeholders (not to mention future generations). Assuming that the retail market review supports a framework of innovation and competition (and that the new faster switching programme is scalable), then consumers of the future should have the opportunity of engaging with energy providers more frequently, with an array of smart products and alternative carbon zero services. Such engagement could likely be encouraged through incentives in an effort to change consumer behaviour. The changes to society, technology and industry will reaffirm the operating mandate of Ofgem, ensuring that during this eco-renaissance all consumers are protected and no one is left behind.