The EBDS scheme will extend available bill support for eligible non-domestic customers until 30th March 2024, but the p/kWh discounts on offer are significantly lower when compared to the provision under the EBRS.

The current Energy Bill Relief Scheme (EBRS) is expected to cost the treasury in the region of £18bn. The Government had been clear that such levels of support were time-limited, intended as a bridge to allow businesses to adapt.

The new Energy Bill Discount Scheme (EBDS) attempts to strike a balance between supporting businesses for a further 12 months and limiting taxpayer’s exposure to volatile energy markets, with a reduced expenditure cap of £5.5bn.

As with the current EBRS scheme, Government support may be available to any non-domestic customer who:

There are three levels of support outlined under this scheme.

The majority of eligible customers will be covered by the ‘Baseline Discount’ Support. This will apply automatically to relevant customer bills as per current arrangements but will represent a significant reduction on support when compared to the EBRS scheme.

A small number of eligible customers maybe covered by the following support mechanisms:

Suppliers will have no role in determining which customers are to be covered by these special mechanisms.

Non-domestic customers who believe they may qualify will be required to register online via a government portal, details of which are forthcoming.

Much like the concept under EBRS, eligible customers will receive a p/kWh unit rate discount on their energy bills, calculated in relation to the difference between the supposed wholesale costs of their contract and the government ‘Supported Price’.

However, the ‘Supported Price’ under EBDS:

And the support available, no matter the calculated difference, is capped at the ‘Maximum Discount’:

Note: The figures represent the ‘Baseline Discount’.

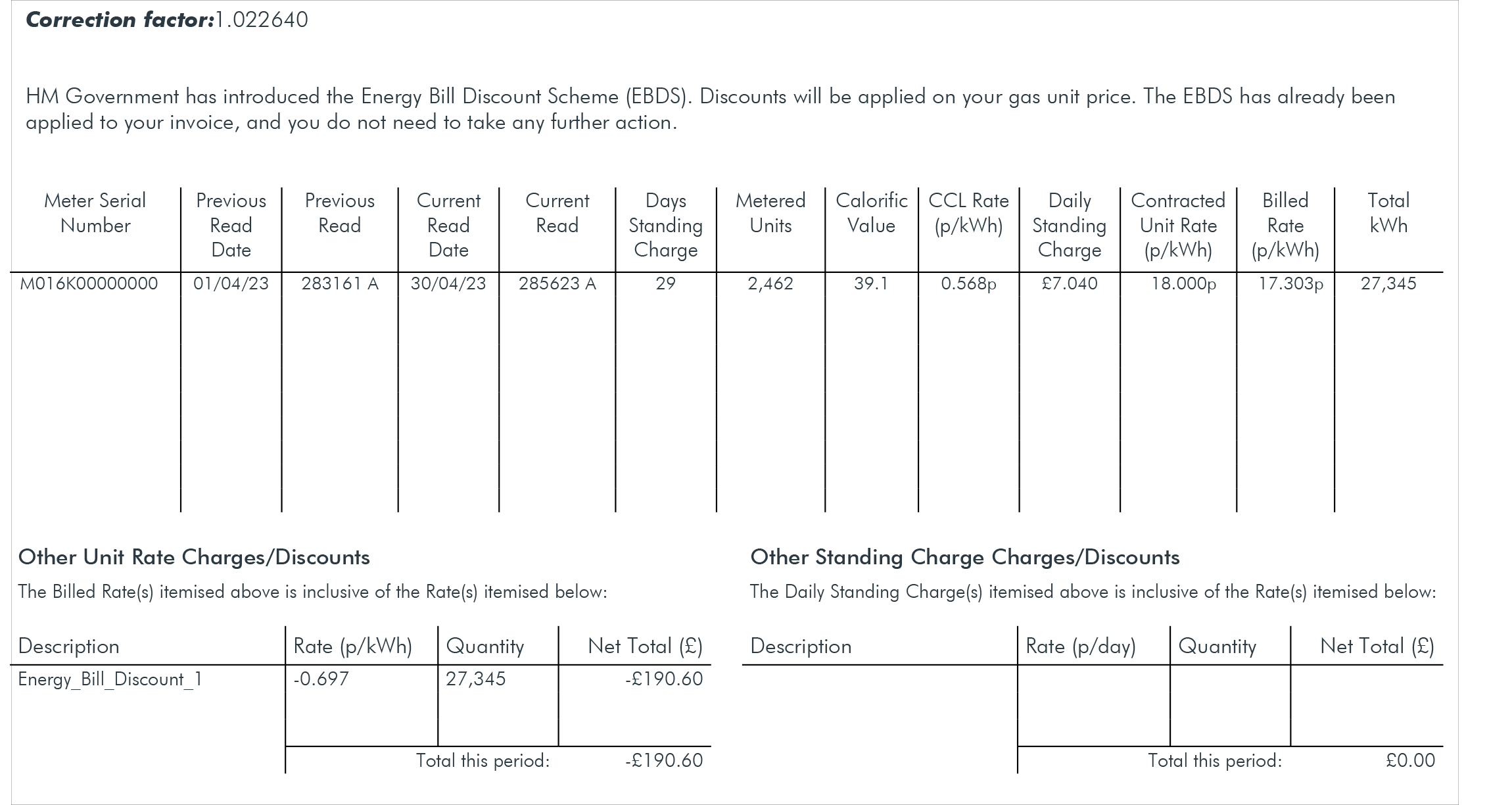

All customers will be automatically transferred from the EBRS to the EBDS on the 1st April 2023 and any relevant discounts will be applied and displayed on invoices as per the below example.

Example 1 (Gas):

Please Note: Reference wholesale prices published by the Government to date can be found here

EBRS Discount For any consumption between 01/10/2022 – 31/03/2023 this customer has been eligible for a 8.93p/kWh discount on their unit rate under the current EBRS scheme.

EBDS Discount For any consumption between 01/04/2023 – 01/10/2023 this customer will be eligible for 0.697p/kWh (the maximum rate available) on their unit rate under the new EBDS scheme.

Taking example 1, an invoice would look similar to the below:

Example 2 (Gas):

EBRS

For any consumption between 01/12/2022 – 31/03/2023 this customer has been eligible for a 2.99p/kWh discount on their unit rate under the current EBRS scheme.

EBDS

For any consumption between 01/04/2023 – 01/12/2023, as the reference wholesale price for this contract is below the EBDS Supported Price of10.7p/kWh, this customer will be eligible for 0 discount under the EBDS scheme.

Throughout the EBRS scheme those supplied on an Out of Contract or Deemed basis have been eligible for the EBRS maximum discount of 9.1p/kWh for gas and 34.5p/kWh for electricity. These discounts have been subject to the relevant floor price of 7.5p/kWh for gas and 21.10p/kWh for electricity.

Under the EBDS, discounts applicable to such variable contracts will be reviewed and published periodically. Support published will not exceed the Maximum Discount level, which has been set much lower than the previous scheme.

Suppliers reserve the right to amend their published Out of Contract/Deemed rates at any time meaning if market prices continue to rise, your price may also increase.

Recognising that these energy users are particularly vulnerable to high energy prices, businesses operating in these sectors will receive a higher level of support across 70% of their consumption, with a lower price threshold and a higher Maximum Discount.

Non-domestic customers who believe they may qualify should register online via a Government portal, details of which can be found here

A Heat Network is defined as “a network that, by distributing a liquid or a gas, enables the transfer of thermal energy for the purpose of supplying heating or hot water to a building or persons in that building”. To further be a ‘Qualifying Heat Network’ it must serve at least one domestic consumer.

There will be no Maximum Discount for QHS.

However, in applying relevant discounts published by the Government, suppliers must ensure that the QHS customers unit rate does not fall below the ‘Minimum Supply Price’.

The Minimum Supply Prices will be set as follows:

*This supply price will be amended to 6.50p/kWh (gas) and 28.24p/kWh (electricity) from the 1st February 2024, and will apply to all fixed and variable contracts entered into on or after this date.

See Government discount published here

Worked Example 1:

A QHS customer agrees a fixed contract for gas on 09/04/2023 at 5.00p/kWh.

Since the unit rate (5.00p/kWh) is below the Minimum Supply Price (7.83p/kWh), the discount the customer receives is 0.

Worked Example 2:

A QHS customer agrees a fixed contract for gas on 09/04/2023 at 15.00p/kWh.

The relevant discount for this QHS customer is 4.6009p/kWh.

The customer receives a discount of 4.6009p/kWh and pays 10.3991 p/kWh for their gas.

Worked Example 3:

A QHS customer agrees a fixed contract for gas on 09/04/2023 at 10.00p/kWh.

The relevant discount for a QHS customer is 4.6009p/kWh.

Applying this discount would give the customer a price of 5.3991p/kWh, which is less than the minimum supply price of 7.83p/kWh.

The customer therefore pays the Minimum Supply Price, meaning a 2.17p/kWh discount has been applied.

Non-domestic customers who believe they may qualify should register online via a Government portal, details of which can be found here

Suppliers will have no role in determining eligibility, non-domestic customers who believe they may qualify will be required to register online via a government portal, details of which are forthcoming.